The COVID-19 pandemic has severely impacted the global economy with an estimated drop in global GDP for 2020 by $5.25 trillion and more than 195 million job losses.

According to the WTO, the most optimistic scenario would be the volume of global merchandise trade expecting to fall by 13% this year, compared to 2019. In the worst-case scenario, global trade volume is expected to fall by 32% compared to 2019.

With falling consumer demand and most governments enforcing lockdown’s, the shipping industry has been badly affected. Here’s an analysis of the quantitative and qualitative impact of COVID-19 on the shipping industry and what your company can do to navigate these tumultuous times.

Changes to global import and export activity

Ports around the world have experienced different changes to congestion levels, due to the nature of goods that are imported and exported.

Shipping of essential goods

As lockdowns were imposed around the world, global import and export activity dropped. However, the export of essential goods has increased, most notably from China, especially once the country was able to stabilise the COVID-19 impact and get back to manufacturing.

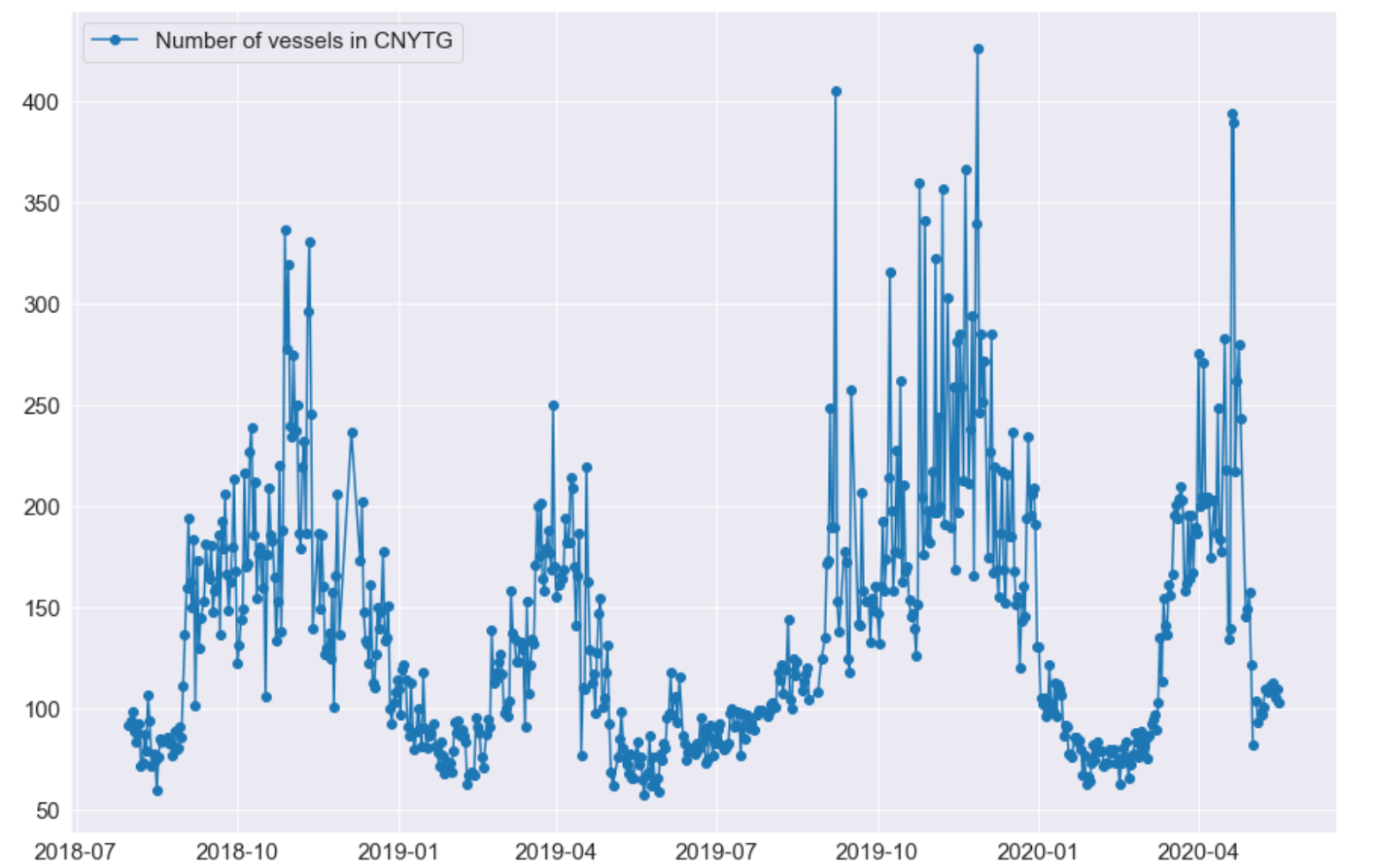

This can be seen in the case of Yantian port in China, where export is the main port activity. Based on the data provided by Portcast, port congestion levels have increased by close to 3 times from February 2020 to April 2020.

In contrast, port congestion levels in Yantian port only increased by 55% over the same time period in 2019. Therefore, after accounting for seasonal changes, the spike in port congestion levels is likely due to the mass exports of essential goods from China to the rest of the world.

Moving forward, the shipping level of essential goods will depend on how quickly governments lift restrictions on local facilities producing essential goods and how efficiently these goods can be delivered across the country.

If essential goods are efficiently distributed locally, reliance on imports will drop, as well as the shipping of essential goods moving forward.

Effect of lower global demand on supply chain

Higher unemployment has resulted in lower demand for consumer goods and this was likely the cause of lower port congestion levels seen in certain ports.

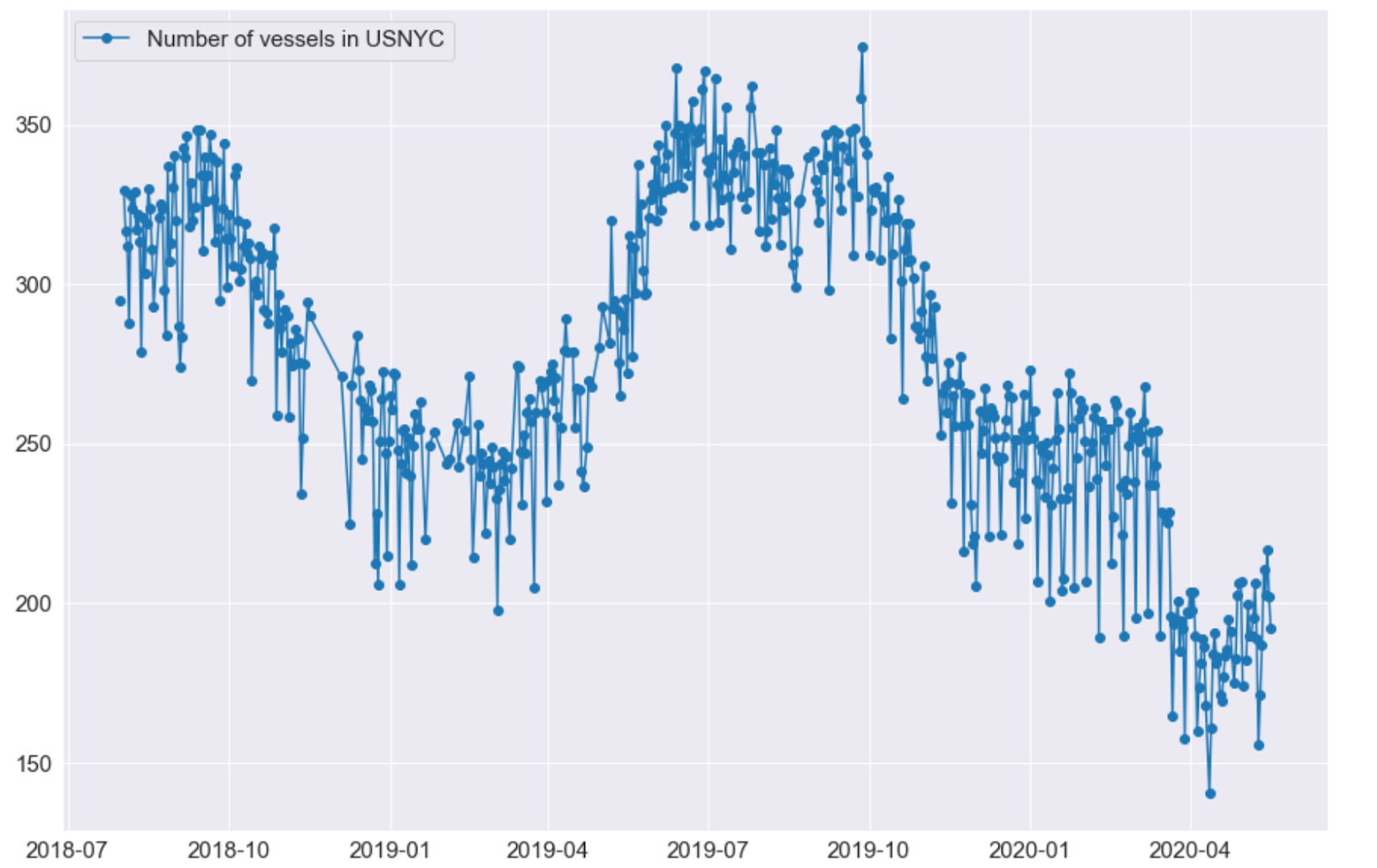

For example, port congestion in New York port has dropped by 32.4% from February 2020 to April 2020. In contrast, port congestion increased by 41% in the same time period last year.

Based on cargo volume data provided by the Port of New York and New Jersey, the majority of cargo handled at the port are imported. Therefore we can infer that the drop in port congestion levels from February to April can be partly attributed to a drop in consumer demand and the rest due to restrictions put in place due to the lockdown. Another side effect has been the concerns of warehouse capacity at ports being overwhelmed given that many retailers were not able to pick up their cargo.

However, as seen in the graph above, port congestion levels have started increasing from May 2020, suggesting a relaxation of restrictions.

Fear of bottleneck in New York port unfounded!

There were concerns about US ports and warehouses being overwhelmed once factories in Asia reopened and some retailers and manufacturers preferring to defer or delay the pick up of their cargo due to worker shortages and warehouse closures.

Furthermore, the arrival of incoming containers when ports have reduced capacity or container storage space to handle cargo that is still stuck would have overwhelmed ports further.

However, that has not been the case thus far, at least in the port of New York. The port authority of New York and New Jersey is confident that a bottleneck can be avoided.

While imports from China are expected to increase, reduced global consumer demand has lowered import volume from other countries.

As it is unlikely for consumer demand to reach pre-COVID-19 levels quickly, the fear of a bottleneck at the port of New York was unfounded.

Blank Sailings peaked in April, with future outlook uncertain

With the drop in demand and trade, shipping lines and alliances were scrambling to skip ports or blank services to manage their ROI in April due to the slowdown in new orders for shippers in March; hence the surge in blank sailings. THE Alliance (Hapag Lloyd, Yang Ming and ONE) announced 32 blank sailings for the Asia-Europe, Trans-Pacific and Trans-Atlantics trade routes for April, providing only a few days of notice.

Based on Portcast’s coverage of 4 carriers, most blank sailings in the second half of May 2020 are for service lanes on the TPP (West Coast) route, closely followed by Asia to North America route.

In a port survey held by Sea Intelligence Maritime Consulting, 76 ports reported between 5% to 25% decrease in calls. However, the number of ports facing a 25% drop in calls fell from 11% in the last two weeks of April to less than 2% in the month of May

Future changes to the blank sailings of specific services will depend on how fast economies restart and the nature of cargo being transported.

Innovation in times of crisis

While Covid-19 has disrupted the global supply chain, opportunities for innovation still exist. Investment in predictive analytics to improve supply chain visibility is one such opportunity.

By combining real-time data and machine learning, predictive analytics provides companies with accurate predictions on vessel arrival times and cargo demand. Consequently, shipping companies, manufacturers and ports can proactively make adjustments to their supply chain based on real-time notifications.

Instead of the constant fire fighting that companies face from external disruptions to their supply chain, companies with better supply chain visibility can mitigate such disruptions in advance, saving significant time and money.

This global pandemic will pass, and companies that take this opportunity to improve their supply chain visibility now will possess an edge over the competition.

About Portcast

Portcast makes global supply chains more predictive and dynamic. Their technology enables logistics companies to improve profitability through dynamic demand forecasting and real-time vessel and container tracking that is inclusive of transshipments.

Reach out to Portcast at contact@portcast.io for a demo today.