Beyond Incoterms: Your Guide to Advanced Strategies for Managing International Trade Risks

International commercial terms (Incoterms) are necessary for defining responsibilities, costs and risk transfer in international trade. But only a specific set of operational risks related to the delivery of goods is covered in these terms. There are even more complexities in international trade. In today’s volatile world, where currency markets are volatile, there is geopolitical turbulence, environmental shocks, and regulatory changes, businesses need to come up with advanced strategies that extend far beyond Incoterms. In this guide by Pristine Market Insights, we’ll navigate through the global trade and its risks, Incoterms and their use, and why it is the need of the time to use advanced strategies that extend far beyond Incoterms.

What are Incoterms?

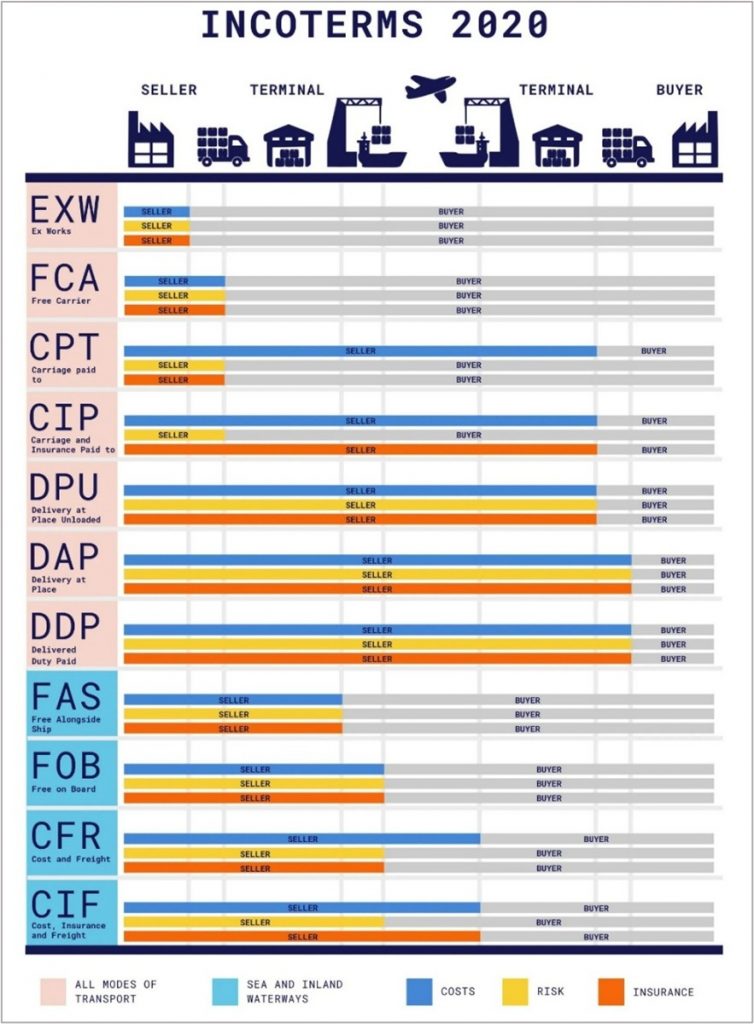

After the First World War era, to bring prosperity to the disrupted trade, several industrialists, financiers, and traders thought of creating industry standards for trade that would be recognised in the entire world. These standards, thus formed, were known as Incoterms rules. Incoterms are a set of internationally recognised rules which define the responsibilities of sellers and buyers in the transaction. They ensure the businesses have a smooth export transaction and that they don’t make any costly mistakes, leading to potential losses. It is a set of 11 internationally recognised rules defining the sellers’ and buyers’ responsibilities. Responsibility for payment and management of the shipment, insurance, documentation, customs clearance, and other logistical activities is specified in these terms[1].

The International Chamber of Commerce (ICC) first published Incoterms rules in 1936. They have become the standard in international business rules and are now recognised by the United Nations Commission on International Trade Law (UNCITRAL) as a global standard for common foreign trade terms. Adherence to Incoterms is voluntary, but these rules are a regular part of trade. 2010 Incoterms were modified in 2020, but there are no major differences between the two. The updated Incoterms 202 rules are grouped into two categories as below[2]:

The Seven Incoterms 2020 Rules for any Mode(s) of Transport are:

- EXW- Ex Works (Insert Place of Delivery)

All transportation expenses and the related risks are the buyers’ responsibility once the goods depart from the seller’s premises.

- FCA- Free Carrier (Insert Named Place of Delivery)

The seller hands over the goods to a carrier or at a designated location. Exports custom clearance is handled by the seller.

- CPT- Carriage Paid to (Insert Place of Destination)

The seller pays for the shipping to the desired location. But the buyer takes on the risk when the seller gives the goods to the carrier.

- CIP- Carriage and Insurance Paid to (Insert Place of Destination)

The seller covers transport and insurance up to the agreed-upon location. The risk is transferred when the goods are handed to the first carrier.

- DAP- Delivered at Place (Insert Named Place of Destination)

The seller delivers the goods to the buyer’s destination, and the buyer is responsible for unloading costs and import duties.

- DPU- Delivered at Place Unloaded (Insert of Place of Destination)

(DAT-Delivery at Terminal was replaced by DPU). The seller handles delivery and unloading. The seller bears all the risk and unloading costs up to the destination.

- DDP- Delivered Duty Paid (Insert Place of Destination)

The seller deals with maximum responsibility. All the costs, risks, including duties, taxes, and any other charges, are borne by the seller.

The Four Incoterms 2020 Rules for Sea and Inland Waterways Transport are:

- FAS- Free Alongside Ship (Insert Name of Port of Loading)

The seller drops goods next to the ship, and the buyer takes over all the costs and risks from there.

- FOB- Free on Board (Insert Named Port of Loading)

Until the goods are loaded onto the ship, the seller is responsible for them. Once the goods are on the vessel, the risk and cost are borne by the buyer.

- CFR- Cost and Freight (Insert Named Port of Destination)

The seller pays for transportation but does not pay for insurance. It is transferred to the buyer once the goods are on board.

- CIF- Cost Insurance and Freight (Insert Named Port of Destination)

The seller covers transport and insurance costs.

Why do Incoterms Matter?

It would have been difficult to conduct cross-border business that has different laws, languages, and customs, leading to a total state of chaos, disputes and financial losses. Mentioning who will handle what in a transaction makes the shipping logistics quite efficient and reduces risks. Incoterms are important in international trade as they offer a framework for complex trade transactions. Here are the reasons why Incoterms matter[3]:

Helps in Clarifying Roles and Responsibilities

It is one of the most significant benefits of Incoterms. It provides clear and consistent buyer/seller responsibilities, costs and risks without any confusion, misunderstanding and costly legal battles that arise in cross-border transactions due to varying business practices.

Cost Allocations

Buying the correct term is necessary for companies to avoid unexpected charges and to manage their budget properly. It clearly defines which party is responsible for various expenses throughout the shipping process. For example, in EXW, the seller quotes a lower price, and the buyer pays for almost everything after pickup from the seller’s door to their own. But, in CIF, the seller quotes a higher price, as it covers transport and insurance to the destination port. The buyer pays for the costs from that point. Therefore, it is necessary to understand the overall implications of Incoterm selection on costs and responsibilities.

Helps in Managing Risks

It helps to identify the point when the risk will transfer from a buyer to a seller and vice versa. Both parties can arrange for appropriate insurance coverage if they know this transfer point. For instance, under FOB (Free on Board), as soon as the goods are loaded on the ship, risk is assumed by the buyer. In this, the seller transfers the risk relatively early in the process. Whereas under DDP (Delivered Duty Paid), the seller bears all the risk involved in bringing the goods to the destination (generally the buyer’s premises). Understanding this transfer saves potential losses.

Respond Quickly to Policy Shifts or Tariff Adjustments

Tariff rates and customs procedures are not influenced or reduced due to Incoterm rules, but they help to define the buyer’s and seller’s responsibilities. It also includes who will bear the costs of customs tariffs. It is easy for businesses to mitigate these abrupt tariff changes and ensure smoother cross-border transactions[4].

What is Not Covered in Incoterms?

The buyers and sellers must be aware of the things that are not covered by the Incoterms. They are a set of delivery rules and not a sales contract. Businesses cannot rely solely on Incoterms. There are certain limitations and pitfalls with Incoterms.

Payment Risks:

Incoterms do not control the when and how of the payments. There is no reference to the method or timing of the payment between the buyer and seller. This poses a significant risk to the trade.

Ownership of the Goods:

Incoterms do not legally transfer title to the goods. This is usually taken care of by sales contracts and other legal frameworks.

Breach of Contract:

Incoterms do not have remedies for delayed deliveries. No dispute resolution mechanisms and no address for the liability for the failure to provide the goods. It does not specify the documents required by the seller for the customs clearance process in the buyer’s country.

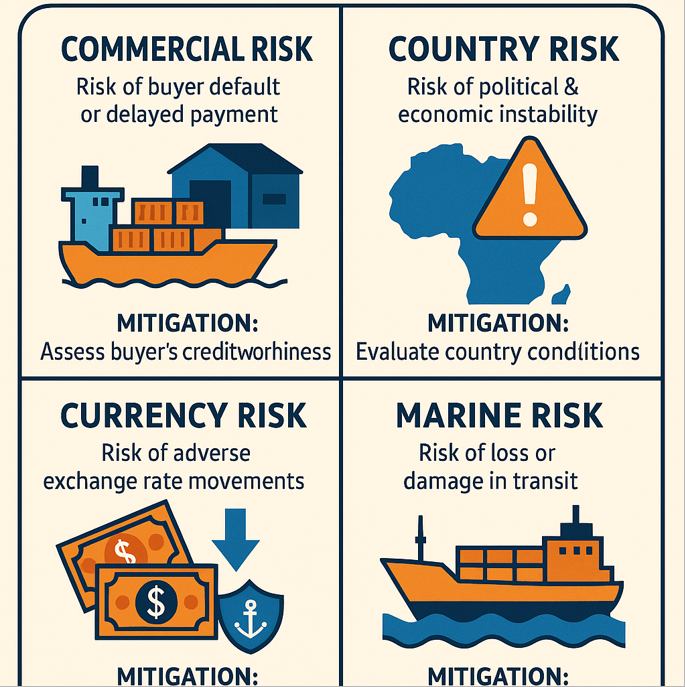

Different Types of International Trade Risks and Their Mitigation Strategies:

Commercial Risk:

Commercial risk refers to when the buyer will not pay for the goods and services, or the seller will not complete the terms of the contract, leading to risks like non-payment, payment delays, or bankruptcy of the partners. This can be mitigated with the help of trade finance instruments such as letters of credit (L/C). This financial statement issued by the bank guarantees the payment to the seller once the terms of the contract are met. Risks of non-payment or delayed payment can be reduced by this.

Another key instrument in trade finance is export credit insurance (ECI), which protects export sales from non-payment and political risks that result in buyer payment defaults. Foreign trade volume is increasing like never before. With this rise, businesses are resorting to various measures to reduce the risks and ambiguities associated with it. The trade finance market has found its way to mitigate the financial gaps and improve the payment system.

Country Risk:

Political instability, economic or social instability in a country, risks the trade network. Companies should conduct a thorough country risk assessment, including the political and economic environment, before entering a new market. Trade can be disrupted by government intervention, political decisions or economic changes, risking the business.

Political risk insurance from an international financial institution like the Multilateral Investment Guarantee Agency (MIGA) protects companies from political instabilities and non-commercial risks. Diversifying markets and suppliers can reduce the risks of any one country.

Currency Risk:

High fluctuations in exchange rates are a major currency risk in trade. The value of the domestic currency relative to the foreign currency keeps changing. This fluctuation can lead to financial losses or increased costs of the goods. For example, a company based in the United States exports goods to. Japan and the yen strengthen against the US dollar, so the company in the US will receive fewer dollars for the exported goods. Such problems lead to lower revenue and profits.

To reduce the impact of exchange rates on a company’s profits, they can match revenues and costs to the same currency. Use of currency hedging instruments like forward contracts, companies can lock in exchange rates for future transactions, reducing the exposure to currency fluctuations. Some other currency hedging options are futures and options.

Marine Risk:

There is a huge financial loss when goods in a vessel are damaged by weather uncertainties. There can also be thefts, piracy or shipwrecks on the carrier vessel. This highlights the need for having marine insurance, that safe that guarantees a safe transit. It covers the damage caused to the vessel, damage to others’ property on board and also includes assistance and gas delivery in case of a stranded situation.

Role of Advanced Technologies in Risk Prediction, Prevention, and Mitigation:

The advent of new and advanced technologies has revolutionised risk management in international trade. It has been easy to predict, prevent and mitigate risks with these advancements. There has been the use of artificial intelligence (AI) and machine learning (ML) algorithms to predict changes in currency exchange rates or economic instability and prevent potential risks. Blockchain technology now provides tamper-proof documentation and contracts.

Documentation risks in trade can be reduced as this solves the problem of transparency and data tampering without one’s knowledge. Blockchain also helps to track goods movement in the supply chain. Product risk can be mitigated with the help of real-time tracking of location, weather, temperature, humidity, and other factors is possible with IoT devices like GPS trackers and smart sensors.

Conclusion

Navigating the complexities of international trade and compliance requires a strategic approach and an awareness of potential risks. Incoterms are a valuable tool for companies involved in international trade. However, Incoterms cannot be solely relied upon, as there are some shortcomings in them. Some risk factors are not covered in Incoterms. It just provides the foundational clarity in international trade. But the complexities in the cross-border transactions are far beyond the mere reliance on Incoterms. Issues like non-payment, bankruptcy, political and economic problems of a country, introduction of new laws and regulations, sanctions, high currency fluctuation rates, and poor weather conditions remain unaddressed in Incoterms.

Various insurances, trade finance instruments, and currency hedging instruments are required in today’s changing international trade landscape. Integration of AI and ML technologies, IoT for real-time tracking, and blockchain for transparency in business transactions will revolutionise the trade network globally. Incoterms are irreplaceable, but they are not enough today with the evolving trade risks.

Frequently Asked Questions (FAQs):

1. Why aren’t Incoterms alone enough for managing international trade risks?

Incoterms define delivery terms but don’t cover payment, legal, political, or financial risks. Businesses need additional tools like insurance, contracts, and financial instruments to manage trade effectively.

2. What types of risks are not covered by Incoterms?

Incoterms don’t address payment defaults, political unrest, currency fluctuations, or contract breaches. These require separate agreements, insurance policies, and financial safeguards beyond standard delivery terms.

3. How can companies mitigate currency exchange risks in cross-border trade?

Businesses use forward contracts, currency options, and natural hedging to stabilise cash flows and protect against adverse exchange rate movements that could impact profitability.

4. How are emerging technologies improving trade risk management?

AI, blockchain, and IoT improve risk prediction, enable secure documentation, and provide real-time shipment monitoring—reducing delays, fraud, and losses in global supply chains.

Author Bio:

Teja Kurane is a research analyst with a keen focus on global trade and risk management. With expertise in international commerce strategies, Teja provides insights that help businesses navigate complex trade environments and optimise cross-border operations. Passionate about market research, Teja bridges data-driven analysis with practical solutions.